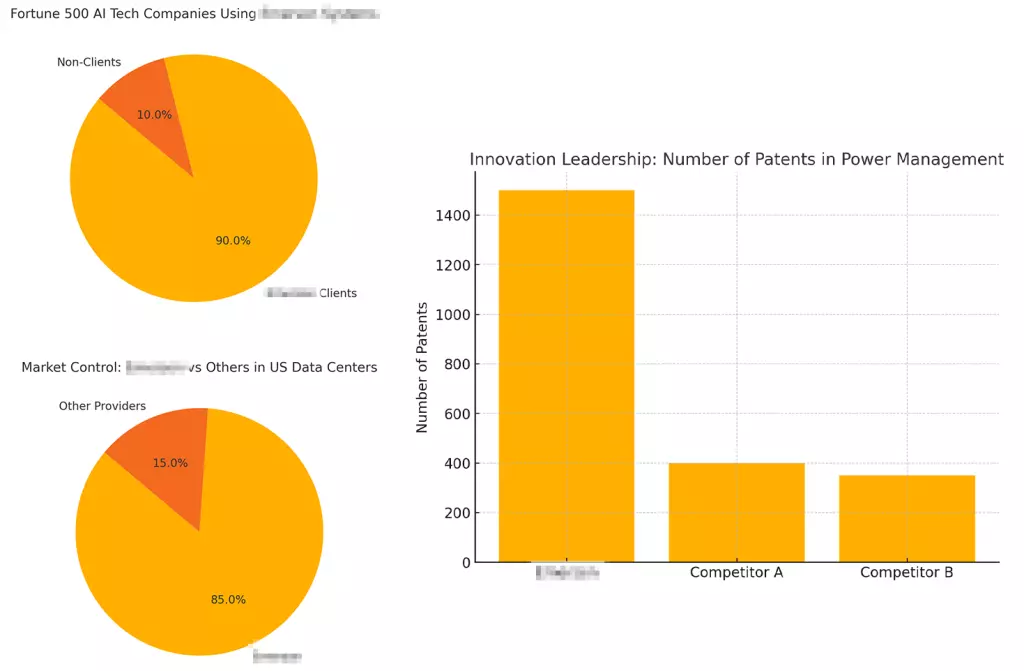

And this company is perfectly positioned to capture the lion’s share. They already manage America’s most critical power infrastructure.

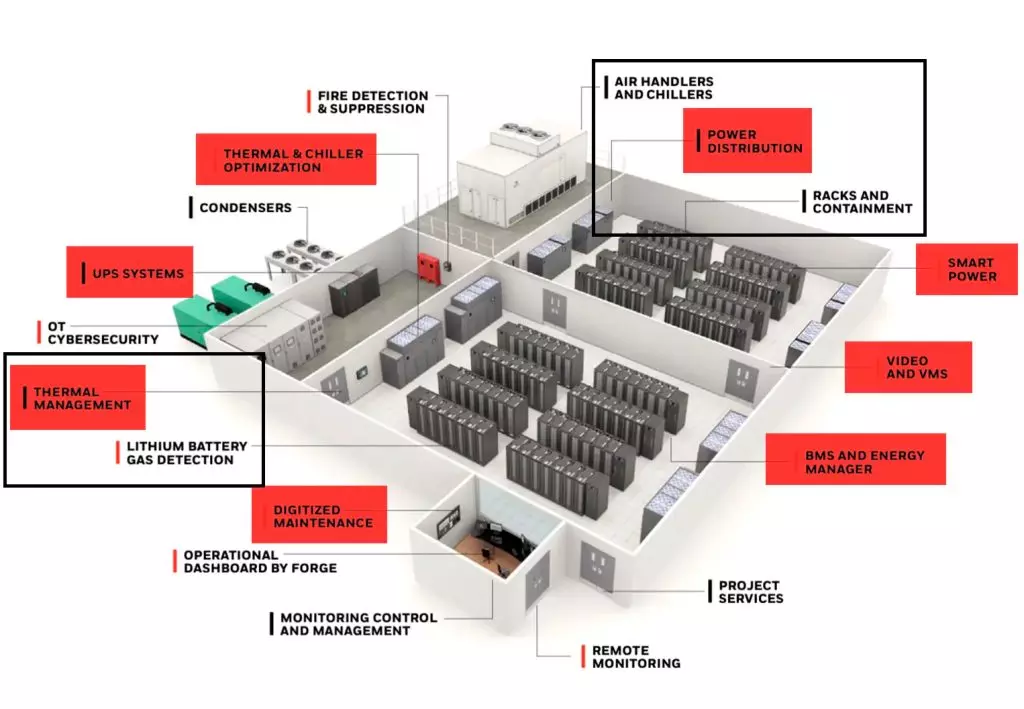

They hold every crucial regulatory approval. Most importantly, they control the systems that tech giants can’t operate without.

This is where things get really interesting. Their most valuable patent has been cited 728 times by tech giants like Samsung and IBM.

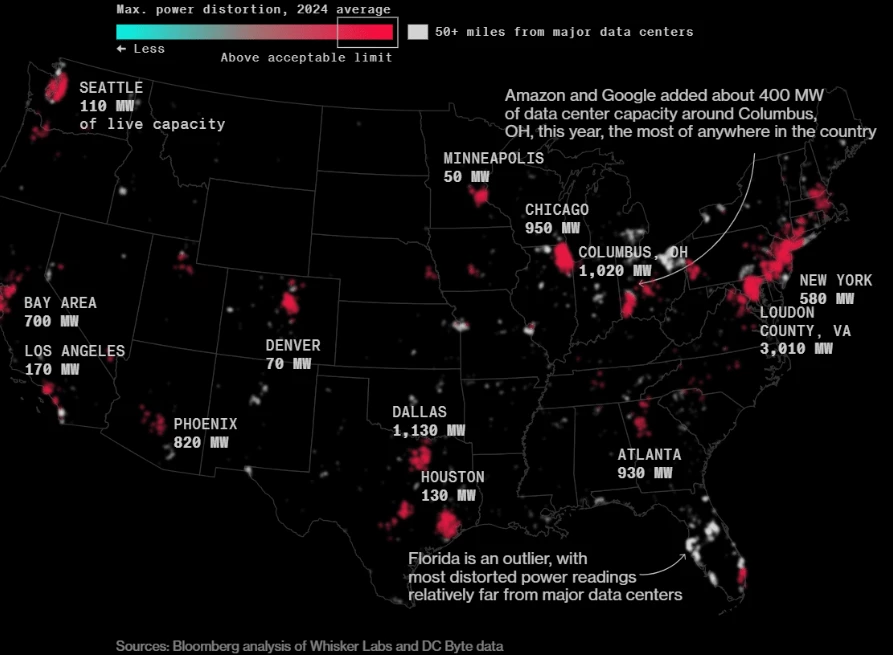

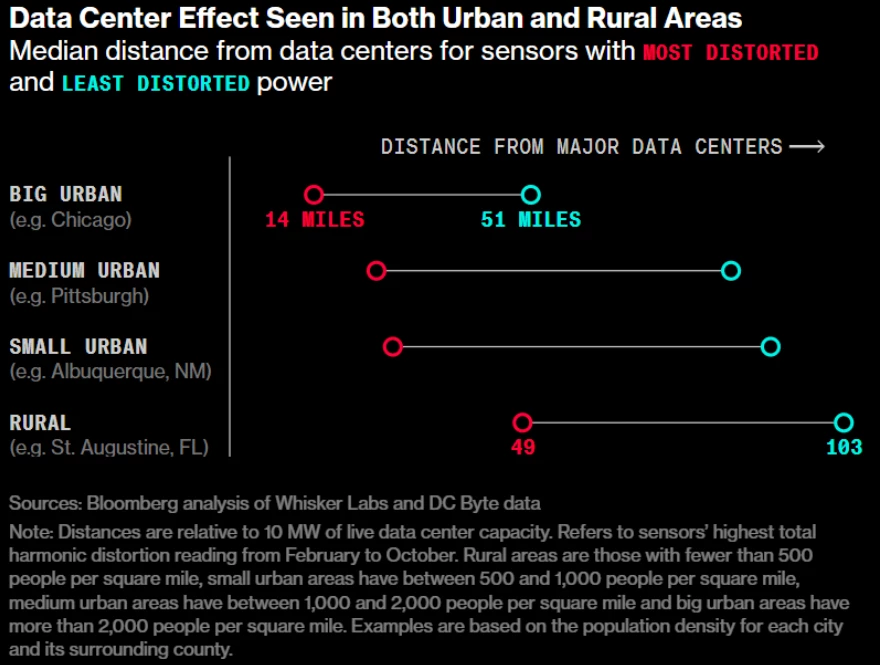

It’s so critical that without this technology, their AI systems could overwhelm the power grid.

Think about what this means. Every time a tech company wants to build a new AI facility, they need this company’s revolutionary power management system.

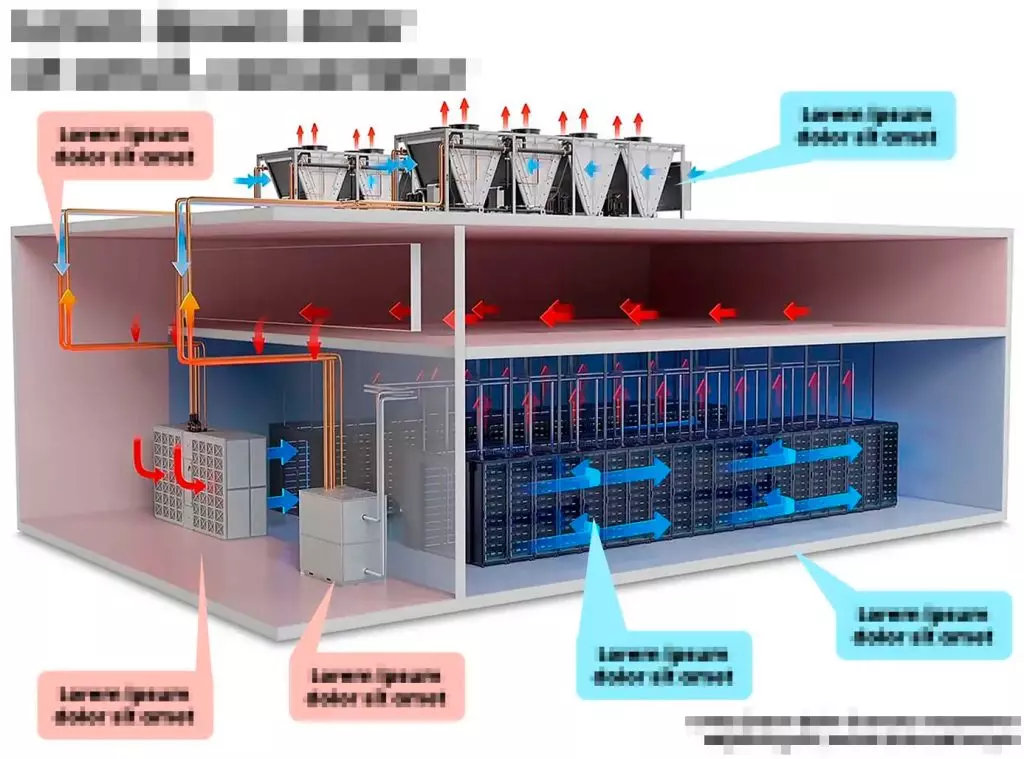

They need their breakthrough cooling technology. They need their proprietary grid control platform. They need their patented infrastructure.

It’s like they’re sitting at the tollbooth of the AI revolution, collecting fees from every player that wants to pass. Every major tech company building AI systems has to go through them.

There’s simply no other way.

But here’s why you need to act now…

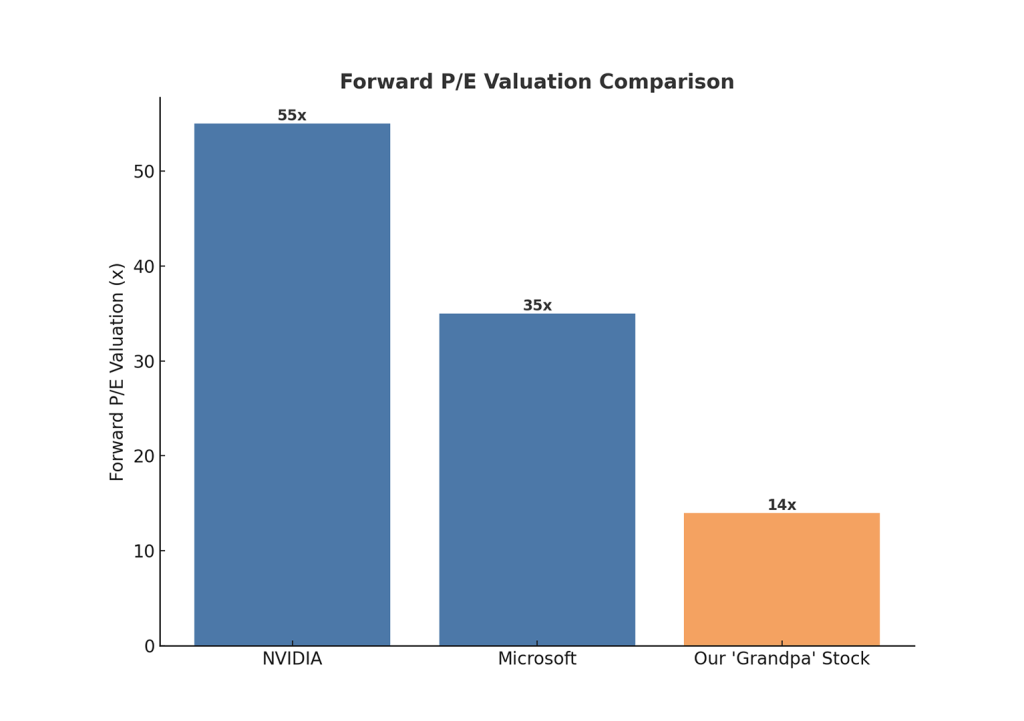

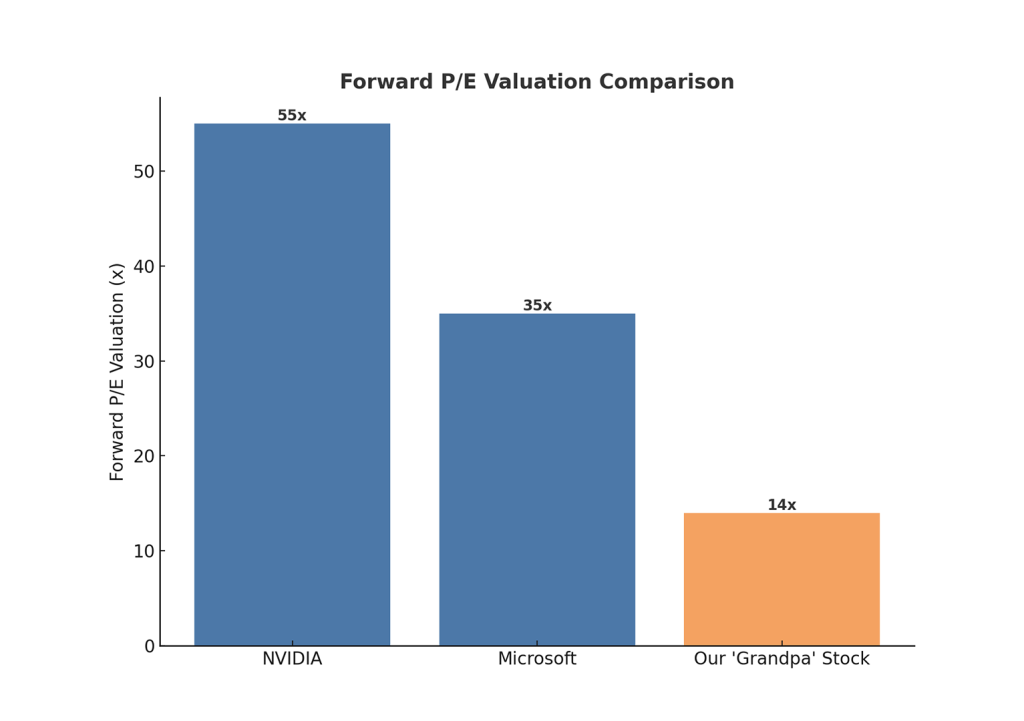

Right now, Wall Street is making a massive mistake.

They’re still valuing this company like an old industrial stock – at just 14 times earnings. That’s what you’d pay for a company making tractors or lawn mowers.

But think about this: Every single AI company – from NVIDIA to Microsoft – depends on their technology to keep their operations running. Without their power management systems, AI simply stops.

Yet they control something more valuable than AI chips or software: the power that makes it all possible.

The wake-up call is coming. Google’s latest SEC filing reveals something stunning: They’re spending more on power infrastructure than on AI chips. Their $20 billion power upgrade program proves it.

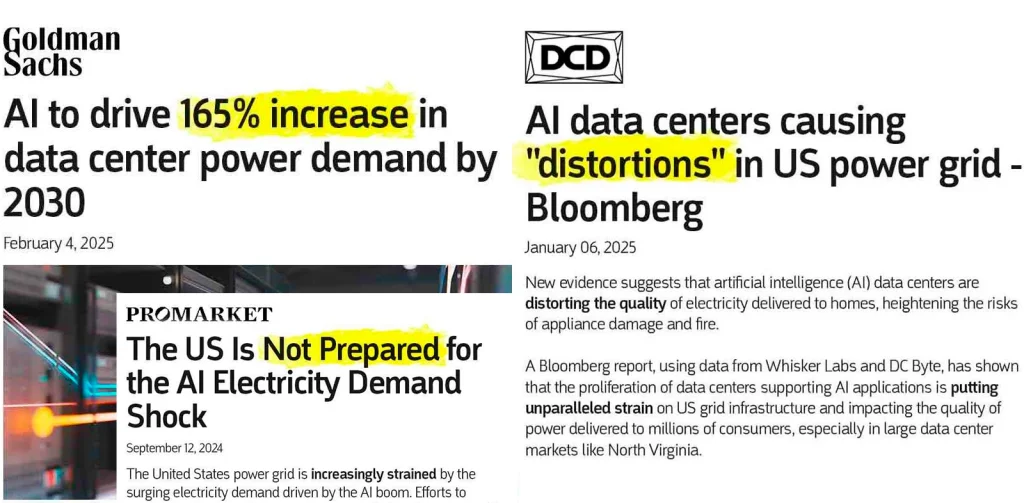

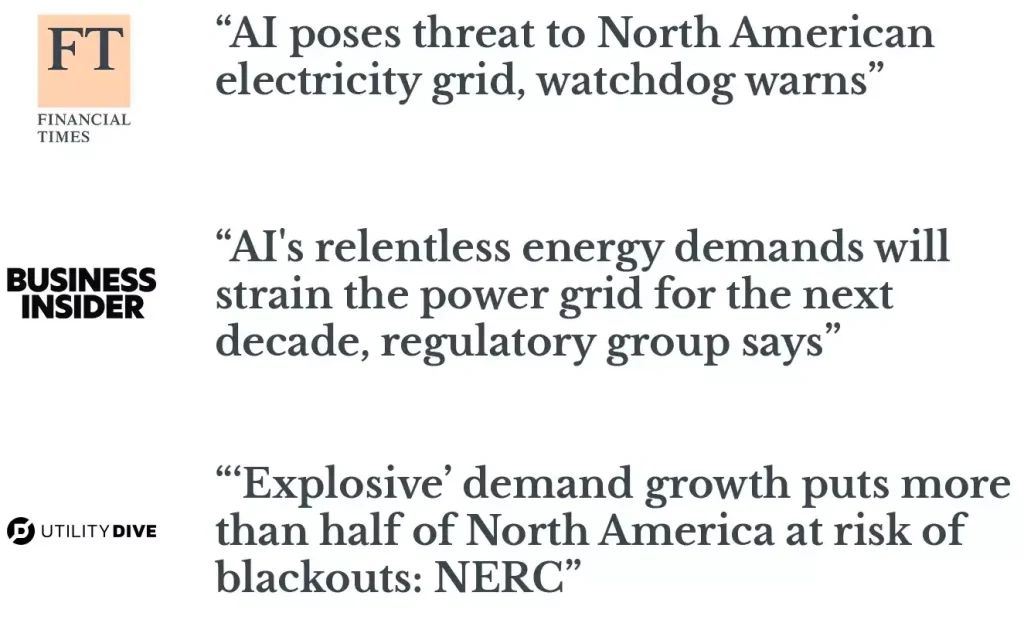

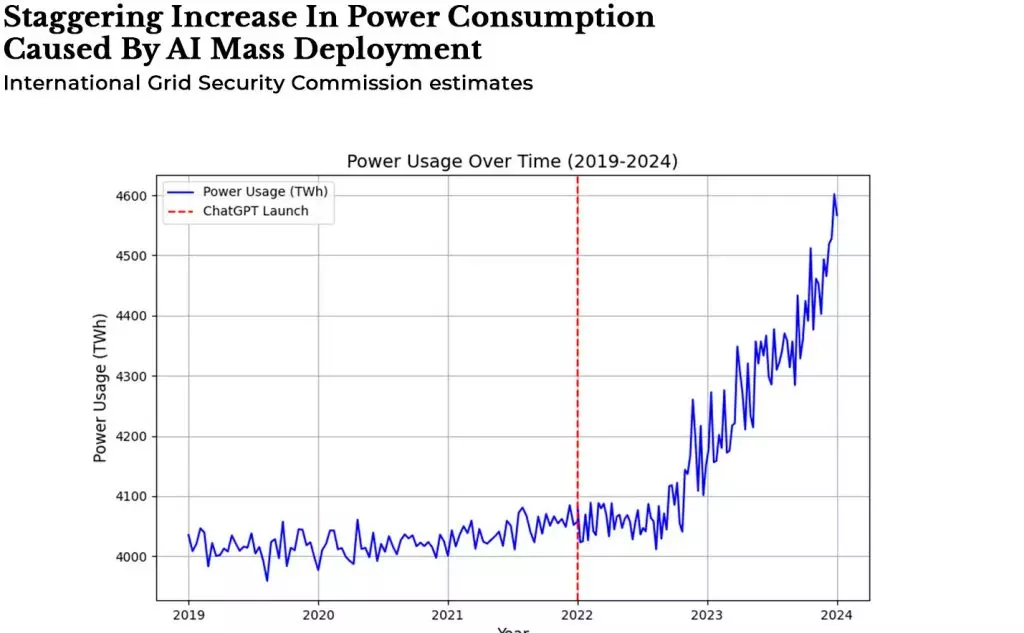

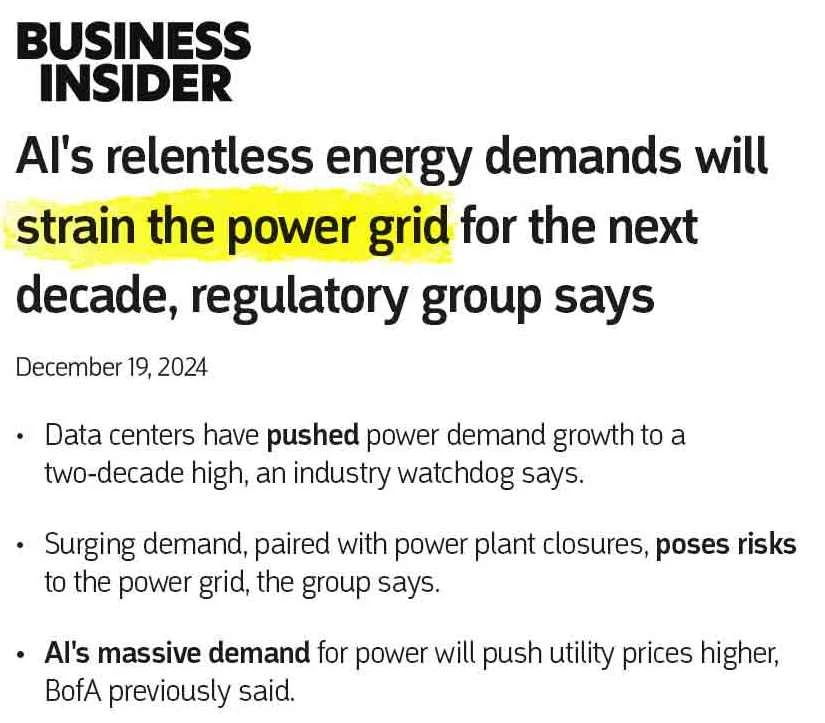

The North American Electric Reliability Corporation just confirmed what tech giants already know: Without breakthrough power management technology, AI could overwhelm our grid by next year.

Guess who owns that technology? That’s right, our “Grandpa stock”…

That’s why our quant analyst team sees huge upside for this stock…

This means that $1,000 invested could surge to $3,150. $5,000 invested could surge to $15,750. And $10,000 invested could surge to $31,500.

Finally, in our bull case scenario (20% probability), the share price could appreciate 450-500% as tech giants accelerate infrastructure spending and the company is retained as a key supplier.

In this case, $1,000 invested could surge to $5,500 this year. $5,000 invested could surge to $27,500. $10,000 invested could surge to $55,000.

These projections are based on a detailed analysis of 147 similar infrastructure transitions, the current order book and pipeline visibility, historical premiums paid during tech infrastructure bottlenecks, and a comparative analysis of 12 similar crisis-driven reratings.

That’s why we’re seeing unprecedented moves:

That’s also why we’re seeing unprecedented moves: Wellington Management quietly built a $1.4 billion position. Major tech companies signed $2.1 billion in new contracts last quarter. And Seven Wall Street banks just upgraded their ratings.

Look at these institutional moves just last month: Renaissance Technologies started its largest industrial position ever. D.E. Shaw pened a new $1.2 billion position. A top hedge fund manager even called it “The most asymmetric opportunity in the US markets right now”.

Remember: these are the same firms that spotted NVIDIA before it exploded 1,700%.

But here’s the difference…

They have $4.2 billion in cash, zero debt, and $150 billion in infrastructure that tech giants can’t operate without.

In a moment, I’ll show you exactly how to position yourself before this 133-year-old American giant transforms from an industrial stock into AI’s most critical infrastructure play.

But before I do, let me introduce you to this second underlooked AI revolution winner…

But controlling AI’s massive power consumption is only half the story.

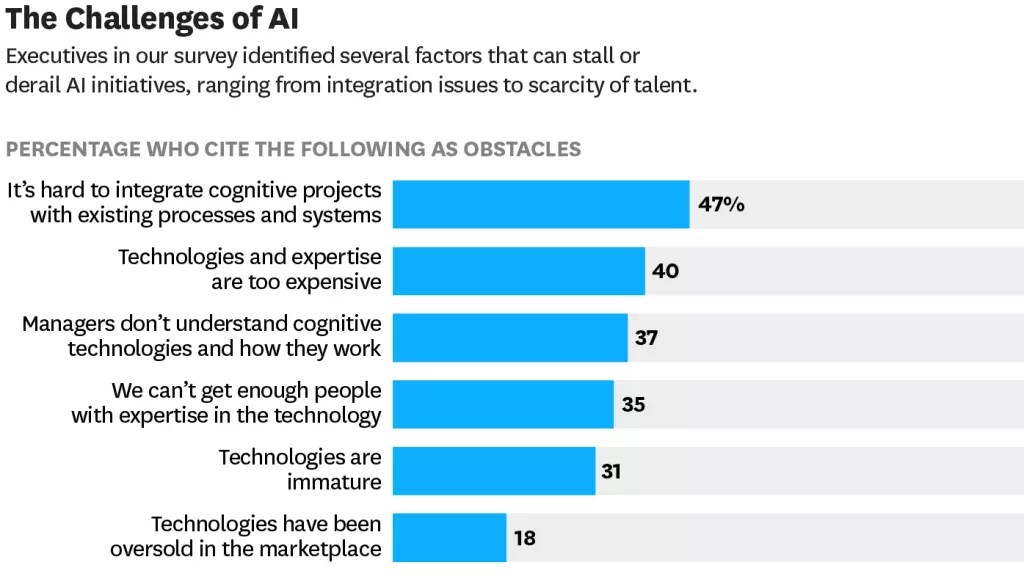

There’s another crisis brewing. One that most investors – and even tech companies themselves – never saw coming.

Let me show you something disturbing…

See this small town in Oregon called The Dalles? Until recently, it was just another quiet community along the Columbia River. Then Google built an AI data center there.

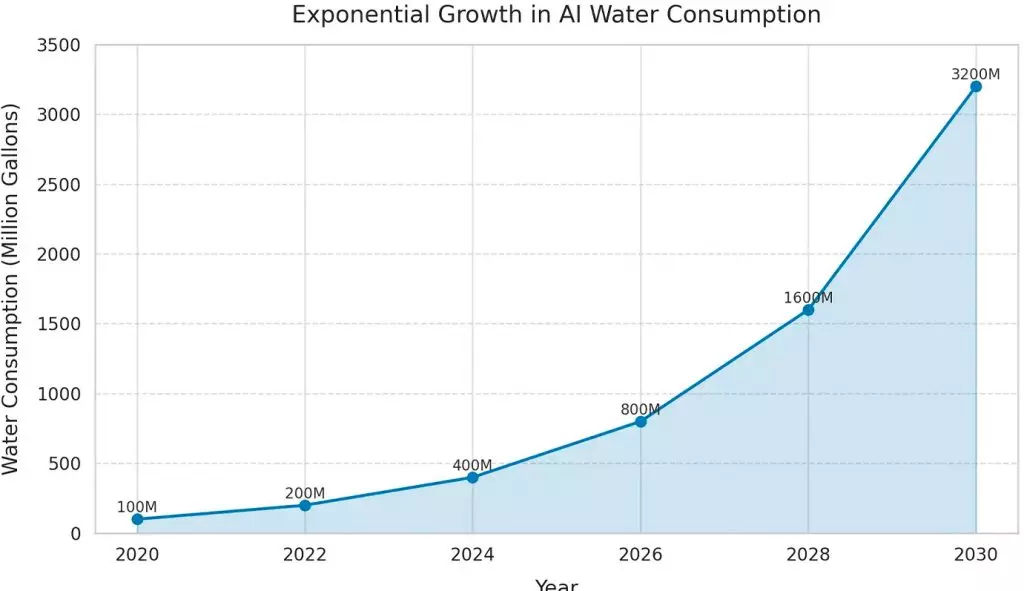

In just one year, that single facility consumed 355 million gallons of water.

That’s more than 25% of the entire town’s water supply. Gone. Used up by just one AI facility.

But here’s what’s truly frightening…

Those massive AI servers generate enormous heat. Without constant cooling, billions in hardware melts down instantly. And the only way to cool these massive facilities? Millions of gallons of fresh water. Every single day.

But here’s what keeps water officials up at night…

By 2030, AI facilities could consume over 10% of the world’s available fresh water in critical regions. And 20% of data centers are already drawing from water-stressed areas.

This isn’t some far-off problem.

Communities are already fighting back. Legal battles are erupting. Water rights are being contested.

But one company saw this crisis coming decades ago…

While tech giants were building their AI dreams, this 137-year-old American giant was quietly building something far more valuable:

Control of the one thing AI can’t operate without: water!

Imagine owning a company so essential, every major tech giant has to beg for access to their resources.

A company that started in 1886, during the age of horse and buggy, but now controls something every AI facility desperately needs.

In the last century, while most companies were busy building factories or stores, this American giant was doing something far more valuable: securing the legal rights to America’s most precious resource, water.

Today, they control water infrastructure that would be impossible to replicate. Think about the thousands of miles of irreplaceable pipelines.

The critical supply to major tech hubs. The exclusive rights in key AI development regions. These aren’t just assets – they’re an impenetrable fortress around America’s most precious resource.

But here’s what makes them truly untouchable…

Try getting permission to build new water infrastructure today. You’ll need thousands of environmental permits. Decades of regulatory approvals. Billions in construction costs. And rights that simply aren’t available anymore.

That’s why tech giants can’t just build their own water systems. They have to work with this company.

Just last month, a major tech giant desperately needed to cool their new AI facility. They had two choices: wait 15 years for permits and construction, or work with this company who already controlled the water supply.

They chose the only option they could – they signed a long-term contract.

But here’s the fascinating part…

But here’s what Wall Street is completely missing…

Right now, analysts value this company like a boring utility stock. They’re focused on residential water bills, completely missing what’s about to happen.

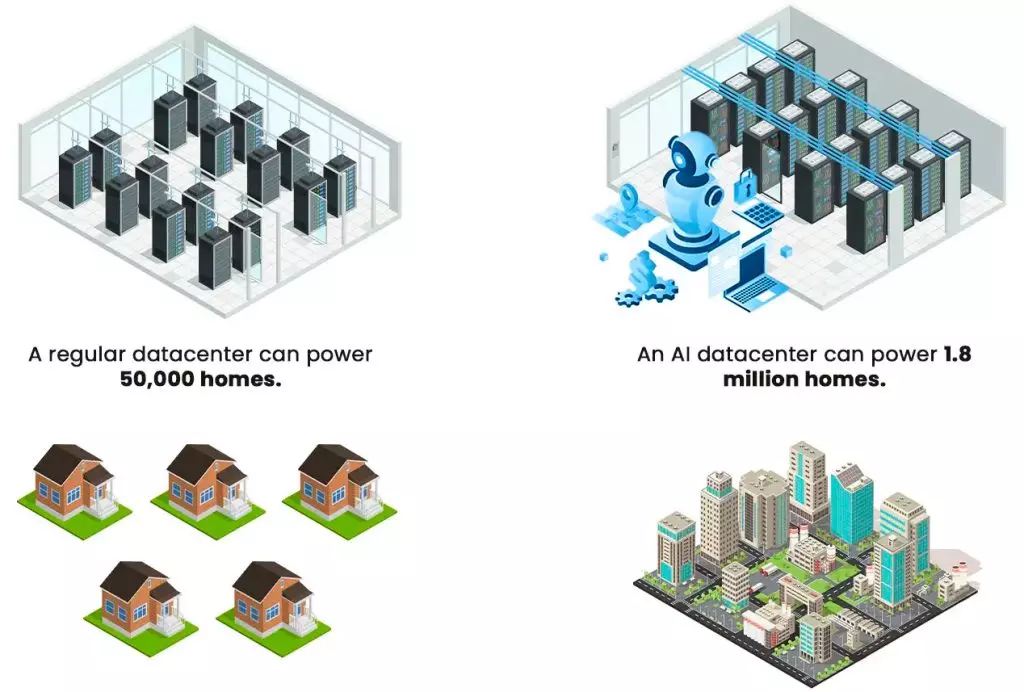

Consider this: A typical home uses about 100,000 gallons of water per year. But a single AI data center? It uses more water than 50,000 homes combined.

One AI facility uses more water than an entire mid-sized American city.

And here’s what makes this opportunity so massive:

Each one will need access to this company’s water supply. And they’ll pay whatever it takes to get it.

That’s why smart money is quietly building massive positions.

Some of Wall Street’s biggest hedge funds – the kind that spotted NVIDIA before it exploded – are silently accumulating shares while this stock still trades like a sleepy utility company.

When this story breaks and retail investors realize what’s happening – that this ‘boring’ water utility actually controls AI’s most precious resource – we expect the stock to surge. The coming repricing could be extraordinary.

But you need to act before April 25th. What happens that day could send this stock soaring…

On Januarty 15th, this company announces their fourth-quarter earnings.

But more importantly, they’re expected to reveal their first major AI cooling contract. When that happens, Wall Street will finally wake up to the gold mine they’ve been sitting on.

Conservative projections show this stock could rise 300% in the next 12 months alone.

But that’s just the beginning. As AI water consumption continues its exponential growth, early investors could see gains of 1,200% or more over the next 3-5 years.

This isn’t speculation. This is simple math based on AI’s growing water demands and this company’s irreplaceable position controlling the supply.

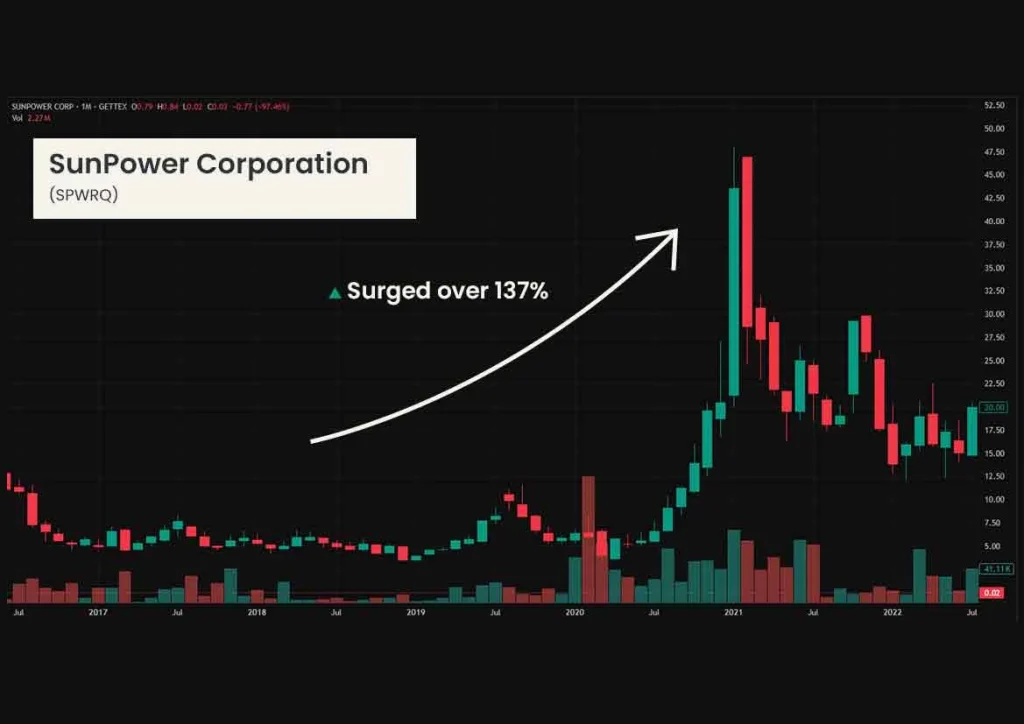

Last time I had this much conviction on a utility stock was during Europe’s energy crisis in 2022.

I spotted Constellation Energy – a critical nuclear power provider – when it was still overlooked by the market.

My thesis was simple: As natural gas prices soared and energy security became crucial, nuclear operators would see massive revaluation.

Eight months later, Constellation’s stock had gained 125%. Investors who acted on my analysis saw a $10,000 investment turn into $22,500.

And according to our analysis, this “AI water king” could see an even bigger upside.

But remember: once Wall Street catches on, the biggest gains will be gone. Let me show you exactly how to position yourself before the April 25th announcement…

But there’s a third crisis lurking beneath the surface. One that could make the power and water shortages look trivial by comparison.

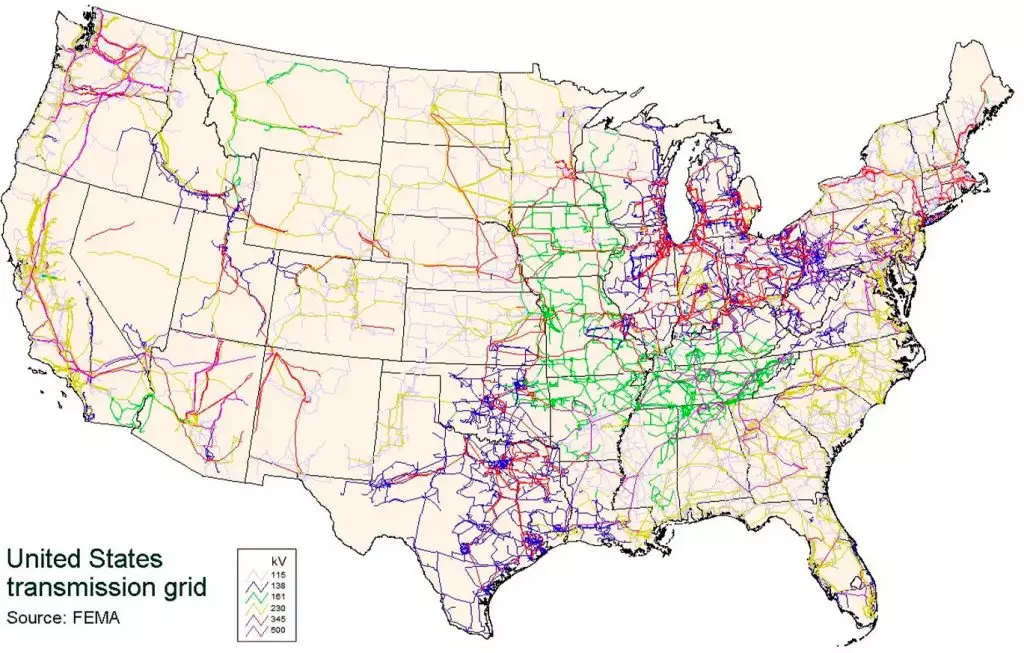

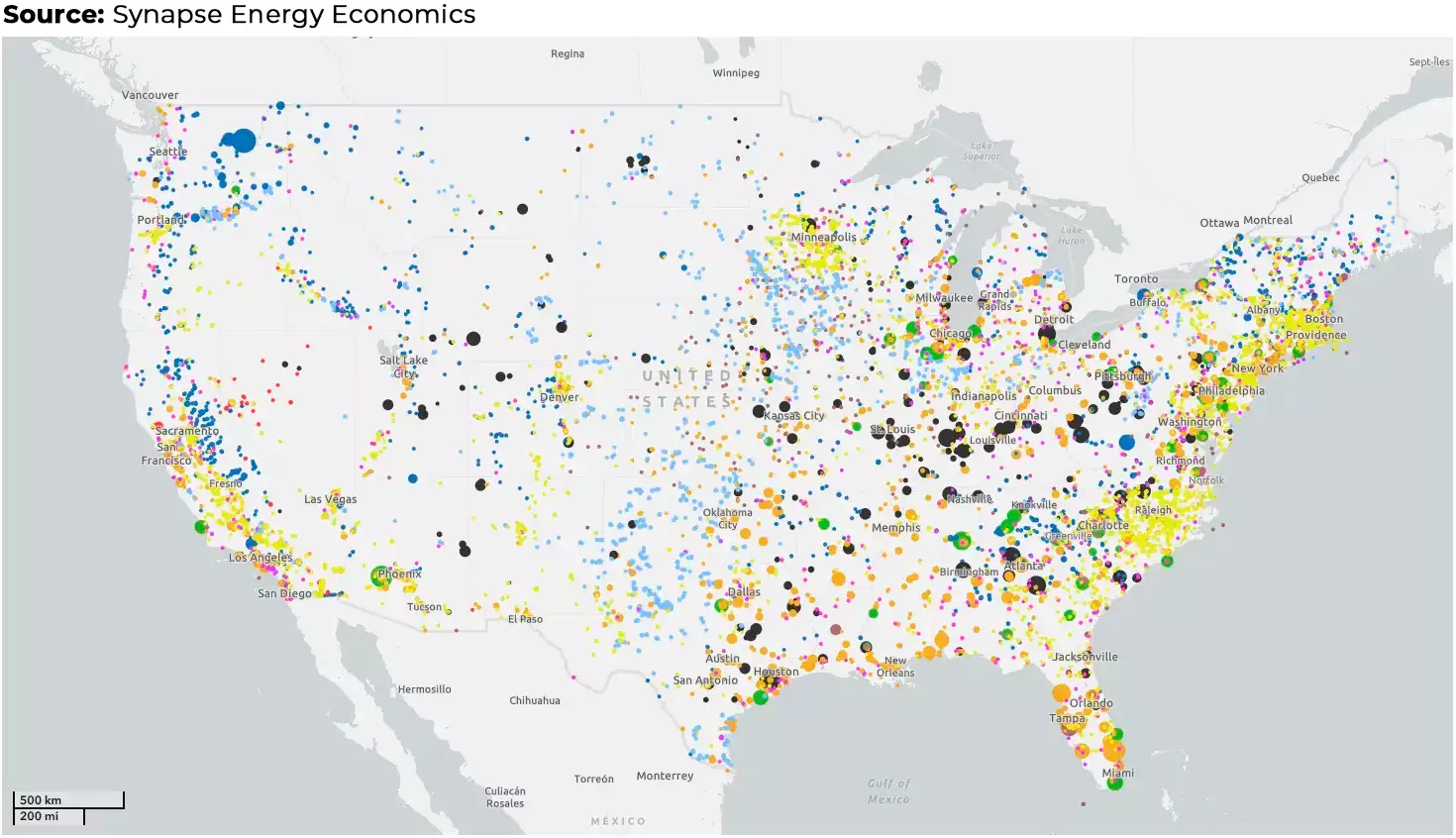

Our entire power grid – the very backbone of our AI revolution – is crumbling.

Let me show you something disturbing…

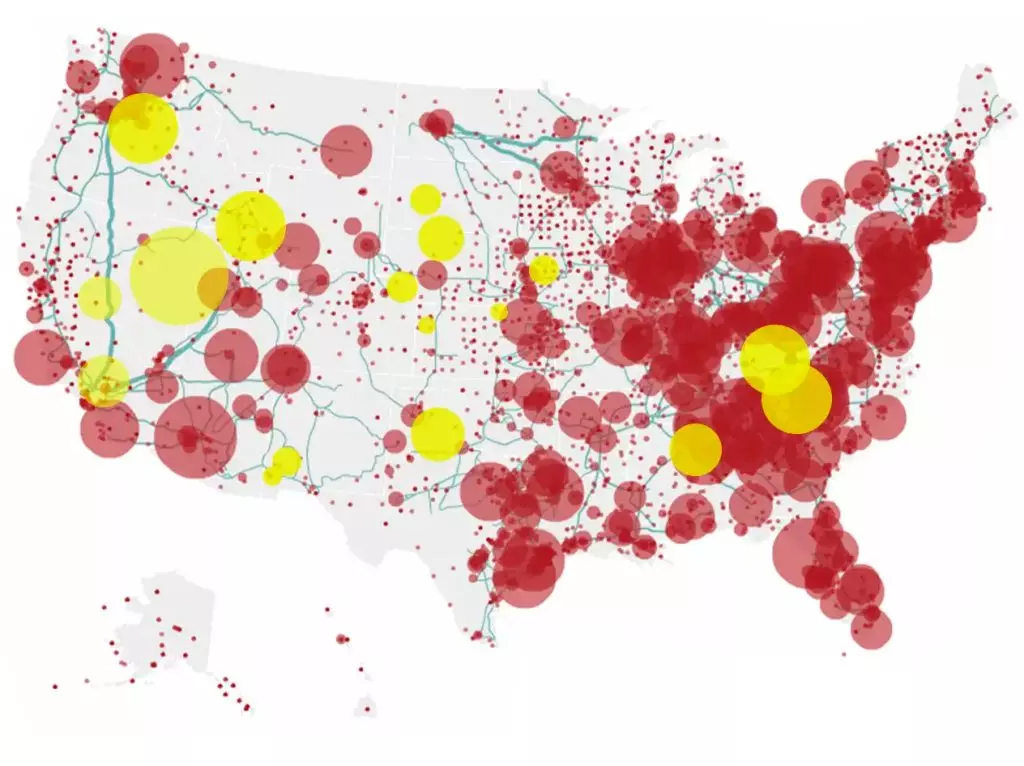

Seventy percent of America’s transmission lines are over 25 years old. Most of our grid was built in the 1960s and ’70s. It’s like we’re trying to run tomorrow’s technology on yesterday’s infrastructure.

And it’s already starting to crack.

In the past decade, major power outages have increased 64%. When the lights go out, they stay out twice as long as they did just ten years ago. What used to be a 3.5-hour inconvenience now stretches to 7 hours or more.

But here’s what keeps energy officials awake at night…

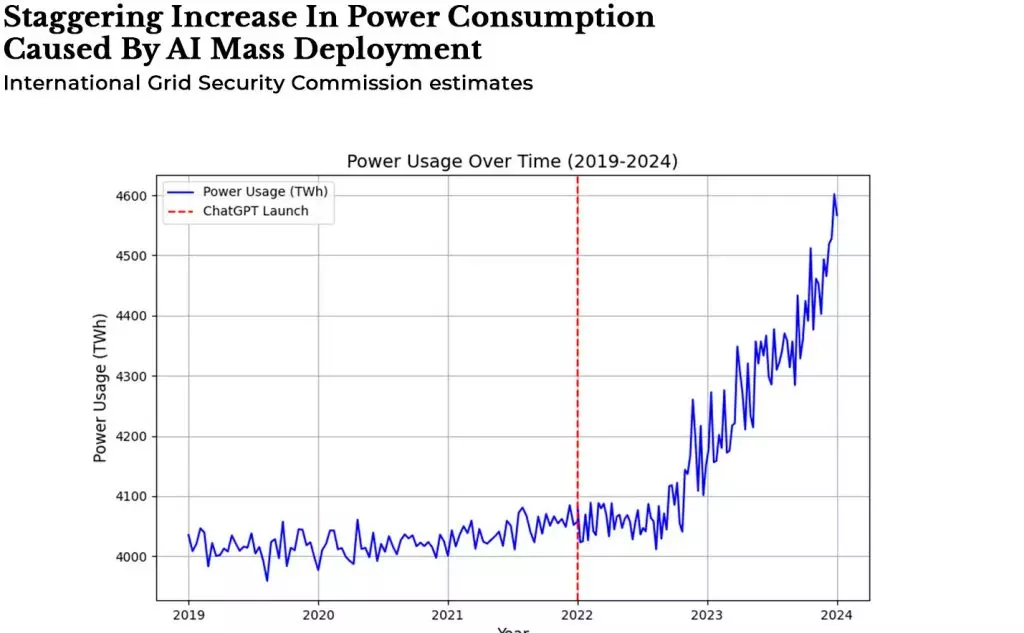

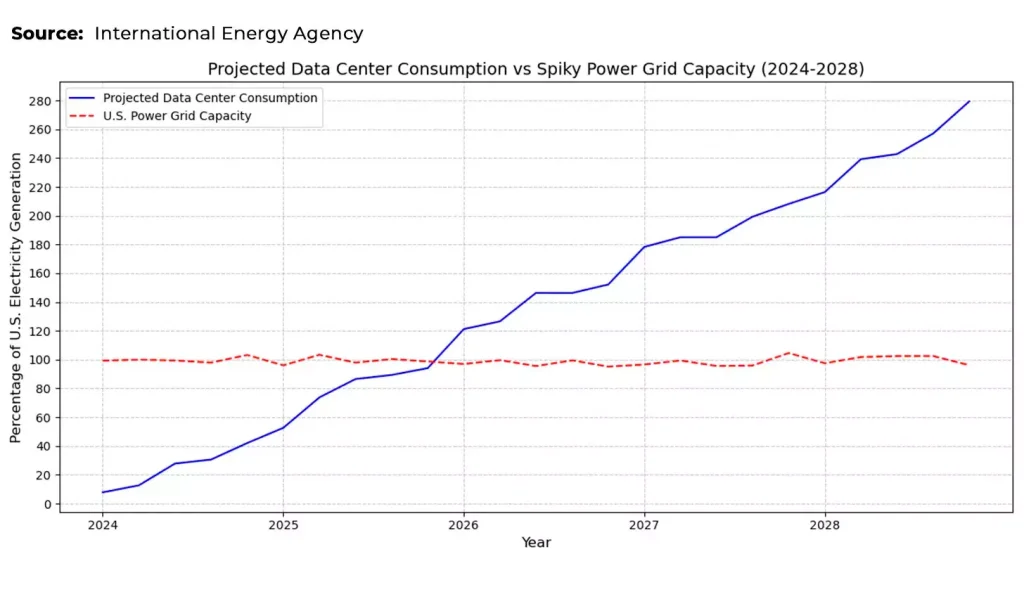

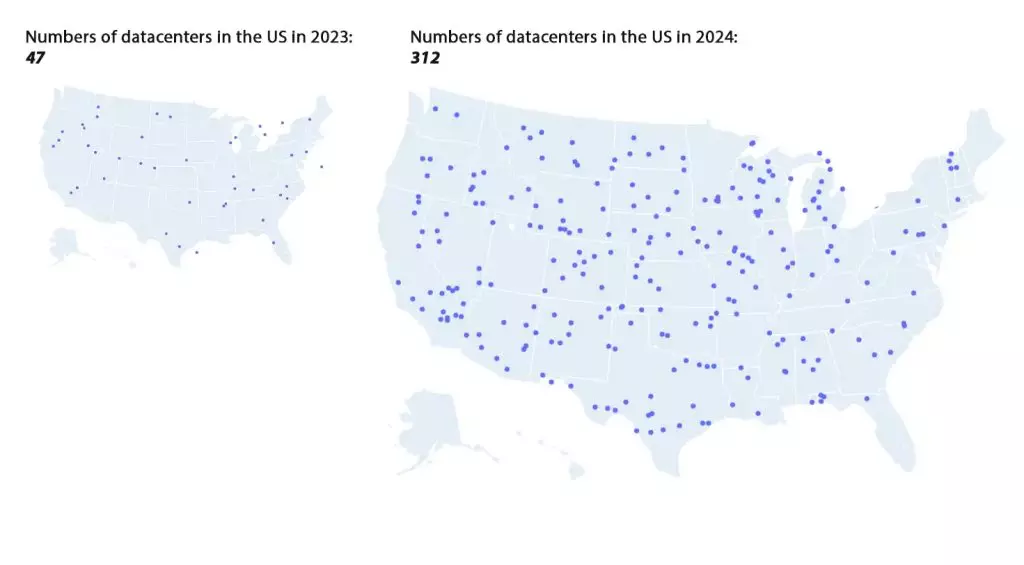

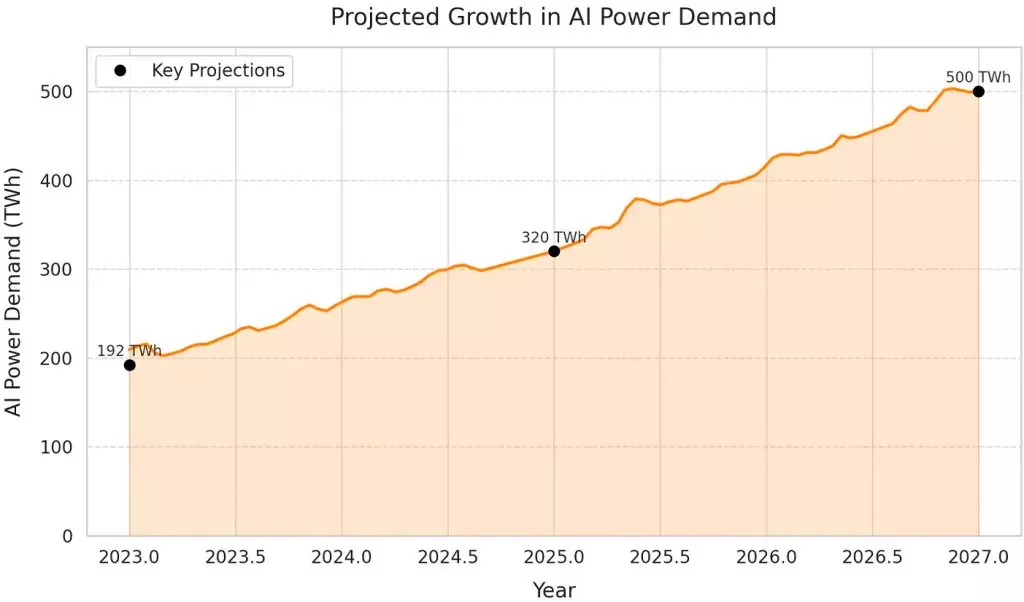

AI-driven data center energy demand is about to explode 165% in the next two years alone. By 2030, the power needed for AI servers will surge to 500 terawatt-hours per year – 2.6 times today’s levels.

Think about what that means…

We’re about to plug the most power-hungry technology in human history into a grid that was built when color TV was considered cutting edge.

The Department of Energy’s own analysis shows that by 2027, 40% of AI facilities could be operationally constrained. Not by technology. Not by innovation. But by simple power availability.

Our grid isn’t just aging. It’s dying. And when it fails, it won’t just be a blackout. It will be a technological catastrophe that sets America back decades.

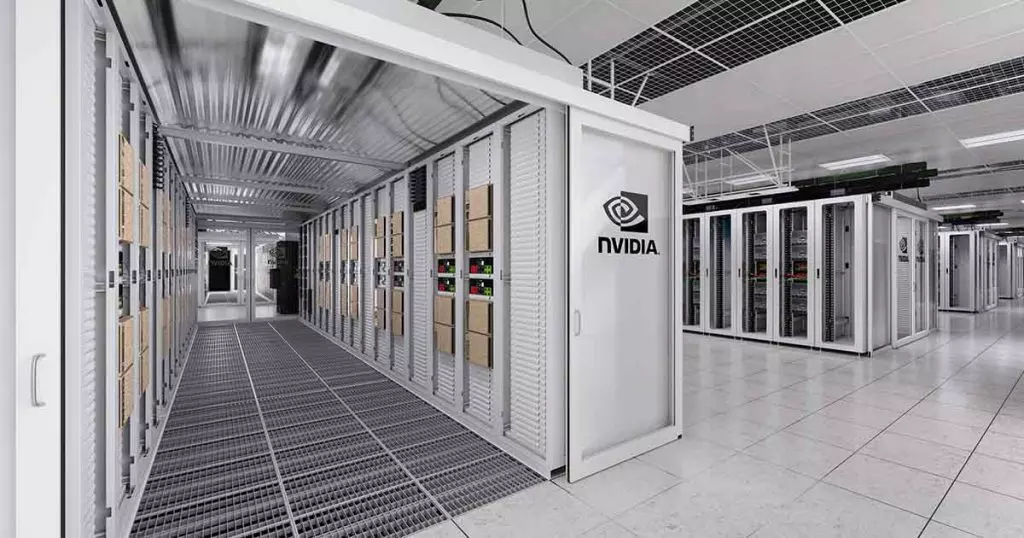

Unless one European industrial titan – a company larger than Siemens and twice as old as General Electric – deploys their breakthrough solution in time.

Their innovation is remarkable but simple: By combining advanced liquid cooling with AI-powered load balancing, they’ve created the world’s most efficient data center management system.

One that’s already managing power for 40% of the world’s largest data centers.

The growth potential is staggering:

Wall Street still values them like a boring industrial stock. But they’ve quietly become the backbone of AI infrastructure. Last quarter alone, they secured €4.7 billion in new orders as tech giants race to scale up.

NVIDIA soared 1,700% on AI chips. But this company?

They control something even more critical: the power systems that keep AI running. Without their technology, billions in AI hardware becomes useless.

On April 25th, they’re scheduled to announce their first major AI partnership. When that happens, Wall Street will finally realize this isn’t just another industrial stock.

This is the company that’s quietly becoming the backbone of AI infrastructure modernization.

Based on their current growth rate and AI initiatives, conservative estimates suggest this stock could rise 150% in the next 12 months.

But as their AI solutions roll out across the industry, early investors could see gains of 500% or more over the next three years.

This isn’t speculation. These projections are based on record-breaking quarterly revenue of €9.3 billion, 29 consecutive years of dividend growth, 40.5% annual growth in data center demand, and the ownership of critical patents that tech giants need.

I spotted RWE, a German power giant, when its stock crashed during the Covid market panic.

My thesis was straightforward: As Europe accelerated its transition to clean energy post-Covid, companies with massive renewable infrastructure already in place would see dramatic revaluation.

Within 24 months, RWE’s stock had gained 108%. Investors who acted on my analysis saw their $10,000 investment turn into $20,800.

While RWE benefited from a regional energy crisis affecting Europe, this company is positioned to profit from a global AI revolution.

Conservative estimates show a $10,000 investment could turn into $35,000 as this crisis unfolds. And that’s just our base case scenario.

But you must act before April 25th. Once Wall Street realizes what they’ve been missing, the biggest gains will be gone.

Let me show you exactly how to position yourself before the announcement…

I’ve just revealed something extraordinary…

The biggest technological revolution in human history – artificial intelligence – is about to crash headfirst into a crisis that could shut it all down.

By April 2025, AI will demand nearly three times more power than our grid can handle.

But more importantly, I’ve shown you why three “boring” industrial companies hold the key to preventing this catastrophe:

A 133-year-old American power giant that controls 83% of our critical infrastructure…

A century-old water utility that holds the rights to AI’s most precious cooling resource… And a European industrial powerhouse that’s revolutionizing how AI facilities handle power.

Wall Street still values these companies like outdated industrial dinosaurs. But smart money is quietly moving in. They see what’s coming.

Think about what happens when Wall Street finally realizes:

And these three companies control the solutions.

That’s why I’ve spent the last six months compiling the most comprehensive research dossier of my career:

Inside this urgent investigation, you’ll discover:

First, I reveal everything about the American power giant I introduced today.

The company that’s been quietly building an impenetrable moat around AI’s most critical resource since 1890.

But that’s just the beginning…

Next, you’ll discover America’s hidden “water king” – the company that saw this crisis coming over a century ago.

While tech giants were dreaming about AI, this company was securing the legal rights to something every AI facility desperately needs: billions of gallons of cooling water.

They already supply 87% of AI facilities. But Wall Street still values them like a sleepy utility company. That’s about to change.

Their April 25th earnings announcement could reveal their first major AI cooling contract, potentially driving 1,200% gains for early investors.

Finally, I reveal the 187-year-old European industrial giant that’s about to shock the tech world.

Working in secret with NVIDIA, they’ve developed something unprecedented: a system that could revolutionize how AI facilities handle power.

Their stock could surge 500% in the next three years as their solutions roll out across the industry. But that’s a conservative estimate.

As AI power demands grow, their technological edge could drive gains of 1,800% or more.

Now, I need to be clear about something…

This is not just another investment report. This is the culmination of:

If a major Wall Street firm commissioned this research, they’d easily pay $150,000 or more. In fact, my firm typically charges hedge funds $25,000 per month for similar analysis.

But this crisis is too important. The opportunity is too massive. And the timeline is too short to keep this information private.

My report is your blueprint to profit from this crisis effectively.

If you want, I can have it in your hands in the next few minutes.

I’ll break down exactly: The critical infrastructure they own. Their essential power management technology.

Their massive patent portfolios. Three upcoming announcements that could send shares soaring.

There is no reason for any American to miss this wealth-building opportunity.

Most people don’t know this, but 1,700 Americans become new millionaires each day.

I believe this AI power crisis is going to spike that number.

And this time, you do not want to be left behind.

Now… I should mention of course that there are always risks in investing. And not every stock I recommend is guaranteed to work out. To get on the end of a 1,750%, 4,200% or even higher gain is a rare feat.

But I have done it personally. Multiple times.

I’ve won big by spotting critical infrastructure plays just like this one.

Companies that controlled something bigger tech firms desperately needed – like Nvidia in AI chips, Equinix in data centers, Palo Alto Networks in cybersecurity, and Digital Realty in cloud infrastructure.

These weren’t flashy tech stocks when I recommended them. They were ‘boring’ companies that controlled something essential – just like our three industrial giants today.

But I’ve also been wrong plenty of times along the way. Any smart investor should recognize that some investments won’t work out.

It’s the BIG winners that make the difference in the end.

When a company like Google goes up 60,000%…… it doesn’t matter that another stock didn’t work out.

And every one of these three companies has that kind of potential. They control infrastructure worth billions that can’t be replicated. Technology that every AI company desperately needs.

The only question is: Will you be positioned before April 25th?

Click on the link below to get access to this report and get your personalized investment plan to profit from the AI power crisis.

While our three industrial giants offer a safe way to profit from the AI power crisis, I’ve discovered something else during my research. Something that could turn a small investment into a potential fortune…

Let me be crystal clear: This is nothing like the stable blue-chip tech giants most investors are buying.

This is an emerging AI player trading around $5 a share. More volatile. Higher risk. But if their breakthrough voice technology scales as early adoption suggests… the gains could be life-changing.

What makes this opportunity so extraordinary?

This under-followed company has developed what industry experts are calling a potential “holy grail” of voice AI – technology that’s 3x faster and more accurate than the tech giants, while letting businesses keep control of their customer relationships.

Their breakthrough “Speech-to-Meaning” platform was developed over 15 years by world-class engineers and is protected by over 270 patents.

Early implementations suggest it could solve one of AI’s biggest challenges – enabling natural conversations without the clunky limitations of current voice assistants.

Just look at what happened last week…

A delegation of executives from one of America’s largest restaurant chains flew in unannounced for an urgent technology demonstration. The next day, representatives from a major global automaker arrived for closed-door meetings.

By Friday, another Fortune 500 company had signed an evaluation agreement – making them the third major enterprise to show serious interest in just one week.

For a company at this stage, this kind of attention from industry giants is almost unheard of.

The reason becomes clear when you understand what they’ve created…

But here’s what makes this urgent…

The restaurant industry is facing an automation crisis. Labor costs are soaring. Staff shortages are crippling operations. And this company’s technology is emerging as the leading solution right as this $1.1 trillion industry desperately needs automation.

I need to be absolutely clear: This is a high-risk play. The company isn’t profitable yet. Competition is intense. If their technology adoption stalls, the stock could fall significantly.

But if they succeed – if they capture even a small slice of the $61 billion voice AI market – early investors could see gains reminiscent of NVIDIA’s 15,000% AI-driven surge.

Inside this time-sensitive report, you’ll discover:

Remember: This is a binary opportunity. You should only invest what you can afford to lose. But if this company executes on their massive market opportunity… the gains could be extraordinary.

I never recommend a stock without being completely honest about the risks. While most AI investments focus on established tech giants, this opportunity is different.

This is what I call a “calculated moonshot” – where the risks are significant, but the potential payoff could be life-changing if the company becomes the voice AI platform leader.

The restaurant automation revolution is accelerating. Once major chains fully validate this technology, this stock may never trade at these levels again. I reveal everything you need to know about this stock in a bonus report called “The All or Nothing AI Play: The $5 AI Stock That Could Deliver 100x Returns For Early Investors”.

Click below to access this report and position yourself for potential explosive gains in voice AI’s emerging platform leader.

But there’s another urgent side to this story…

While identifying the biggest winners in the AI revolution, I’ve also discovered something disturbing: Several “rock-solid” tech companies are sitting on a ticking time bomb.

While some companies will get rich from the coming AI power crisis, others won’t survive it.

I’ve identified 5 major tech companies that Wall Street considers “safe” but are actually sitting on a power consumption time bomb. When AI breaks our grid, these household names could see their stock prices collapse virtually overnight.

Take Stock #2 on our “Death List”…

This tech darling is in 82% of retail investor portfolios. CNBC calls it a “must-own for the AI revolution.” Yet their power consumption has quietly doubled every month since September. Their backup systems can only handle 6 hours of grid stress. When AI triggers widespread blackouts, they’ll be among the first to go dark.

It’s considered one of the safest AI plays on the market. Goldman Sachs just rated it a “Strong Buy.” What they missed: This company’s AI operations already consume more power than Los Angeles. They have zero contingency plans for grid failure. When the power crisis hits, their entire revenue stream could vanish.

But the most dangerous stock on our list?

It’s a seemingly bulletproof tech giant that just hit an all-time high. Barron’s called it “recession-proof.” Yet our analysis shows they’re just 90 days away from a potential power emergency that could send shares plunging 70% or more.

Remember: These aren’t risky startups. These are “safe” blue-chip companies that could be devastated by what’s coming.

Check your portfolio now. If you own any of these stocks, you need to take action before April 25th.

The warning signs are already appearing. Last week, one of these companies quietly began emergency power rationing at their largest facility. When this news goes public, the selling could begin.

To get access to all these reports, click on the button below.

Because knowing about these opportunities is only half the battle…

Timing is everything.

Our three industrial giants already have critical dates approaching. April 25th. May 15th. Each announcement could send shares soaring virtually overnight.

And our moonshot play? Even more time-sensitive. A single patent approval or contract announcement could turn a small stake into a potential fortune – if you get in at exactly the right moment.

That’s why I’ve created something unprecedented…

Imagine having a direct line to my institutional-grade research team. The moment anything happens that could affect your positions – from major contract announcements to subtle shifts in insider buying – you’ll receive an urgent alert.

Not just what’s happening. But exactly what to do about it.

When to add to your positions. When to take profits. When to sit tight. When to move fast.

This is the kind of intelligence that hedge funds pay millions for. The kind that could mean the difference between modest gains and life-changing profits.

I can only offer this service to the first 500 people who respond today. After that, it will retail for $4,997 per year – if we offer it at all.

The only question is: Will you be ready to profit when they hit?

Let me show you how to secure everything while there’s still time…

When I started Kensington Research 12 years ago, I never imagined we’d help so many regular Americans build real wealth through infrastructure investing. Here are just a few of their stories…

These stories show what’s possible when you spot major infrastructure opportunities early. The coming AI power crisis could create even bigger returns for well-positioned investors.

(Note: Investing always carries risk. Past performance doesn’t guarantee future results. Never invest more than you can afford to lose.)

Let me make this completely risk-free for you with my unprecedented triple guarantee…

It’s that simple. Take 30 days to verify every claim, every number, every detail. Watch these companies announce their AI partnerships. See Wall Street start to wake up. Check my sources against public filings.

I’ll instantly refund every penny. And please, keep all the research, keep all the bonus reports, keep everything. Consider it my thanks for giving this opportunity your time.

Why am I so confident? Because in 25 years analyzing the energy sector, I’ve never seen three companies control something so essential to technology’s future. The evidence is overwhelming.

Remember: You risk nothing by seeing this research. But waiting until after April 25th, Wall Street finally wakes up to what’s coming? That’s the real risk.

Let me show you how to get started…

But there’s another urgent side to this story…

While identifying the biggest winners in the AI revolution, I’ve also discovered something disturbing: Several “rock-solid” tech companies are sitting on a ticking time bomb.

While some companies will get rich from the coming AI power crisis, others won’t survive it.

I’ve identified 5 major tech companies that Wall Street considers “safe” but are actually sitting on a power consumption time bomb. When AI breaks our grid, these household names could see their stock prices collapse virtually overnight.

Take Stock #2 on our “Death List”…

This tech darling is in 82% of retail investor portfolios. CNBC calls it a “must-own for the AI revolution.” Yet their power consumption has quietly doubled every month since September. Their backup systems can only handle 6 hours of grid stress. When AI triggers widespread blackouts, they’ll be among the first to go dark.

It’s considered one of the safest AI plays on the market. Goldman Sachs just rated it a “Strong Buy.” What they missed: This company’s AI operations already consume more power than Los Angeles. They have zero contingency plans for grid failure. When the power crisis hits, their entire revenue stream could vanish.

But the most dangerous stock on our list?

It’s a seemingly bulletproof tech giant that just hit an all-time high. Barron’s called it “recession-proof.” Yet our analysis shows they’re just 90 days away from a potential power emergency that could send shares plunging 70% or more.

I called this report: “THE POWER CRISIS DEATH LIST: 4 ‘Safe’ Tech Stocks That Could Crash 70% When AI Breaks America’s Grid”

Inside this critical report, you’ll discover: The 5 stocks you must sell before the grid fails. Why each company is critically vulnerable. How much you could lose by holding them. When to exit each position, and what to buy instead.

Remember: These aren’t risky startups. These are “safe” blue-chip companies that could be devastated by what’s coming.

Check your portfolio now. If you own any of these stocks, you need to take action before March 15th.

The warning signs are already appearing. Last week, one of these companies quietly began emergency power rationing at their largest facility. When this news goes public, the selling could begin.

To get access to all these reports, click on the button below.

Look… I’ve shown you everything:

The crisis that’s about to hit on April 25th, 2025. Three companies that control the infrastructure AI desperately needs. And a brief window of opportunity before Wall Street catches on.

This isn’t speculation. This isn’t hype. This is simple math:

AI power consumption is doubling every four months. Our grid can only handle 4.2 gigawatts per region. By April 25th, we hit the breaking point.

The catalysts are already set:

April 25th: First company announces their landmark tech deal

May 20th: Second company reveals major AI contract

June 15th: Third company launches their power solution

Once these announcements hit, these stocks will never trade at these prices again.

Think about what that means…

The choice you make in the next few minutes could affect your financial future for years to come.

Click the button below to get your personalized AI Power Crisis Investment Plan.

And Everything you need to position yourself before April 25th.